🗓️ Market Opening Update – Reliance Power Share Price Context

Reliance Power Share Price | Friday, June 27, 2025 By 11.05 AM, the 30-share BSE Sensex opened at 83766.31, up about 10.44 points, or 0.01 percent. At the same time, the NSE Nifty is trading at 25553.60, up 4.60 points, or 0.02 percent. While the Nifty IT index has gained 101.55 points, or 0.26 percent, to reach 38097.80, the S&P BSE Smallcap index is trading at 54284.64, up 324.07 points, or 0.60 percent.

On Friday, 27 June 25—Reliance Power Share Price Status

Today, Friday, 27 June 2025, as of 11.05 AM, the stock of Reliance Power Limited Company is trading at Rs 67.3, up 1.04 percent. As soon as trading started in the stock market on Friday morning, Reliance Power shares opened at Rs 66.48. As of 11.05 AM today, the high level of Reliance Power Company shares was Rs 67.50, and the low level was Rs 65.55.

📈 52-Week High/Low – Reliance Power Share Price Performance

Today, Friday, 27 June 2025, the 52-week high level of Reliance Power Limited Company shares was Rs 76.49. At the same time, Reliance Power’s share fell to its lowest level in 52 weeks, at Rs 25.75. This stock’s decline from its 52-week peak is -12.01% .At the same time, it has jumped 161.36% from its 52-week low. According to the data available on the stock exchange, an average of 28,073,746 shares were traded daily in Reliance Power Company during the last 30 days.

💼 Financial Snapshot – Impact on Reliance Power Share Price

As of 11.05 AM today, Friday, 27 June 2025, the total market cap of Reliance Power Company is Rs 27,854 Cr, and the P/E ratio of the company is 9.36. Reliance Power Company currently owes Rs 15,153 Cr in total debt.

🚀 Massive Returns – How Reliance Power Share Price is Growing

The previous closing price level of Reliance Power Company shares was Rs 66.6. As of 11:05 AM on Friday, June 27, 2025, Reliance Power shares are trading within the range of ₹65.55 to ₹68.00 on the stock market today.

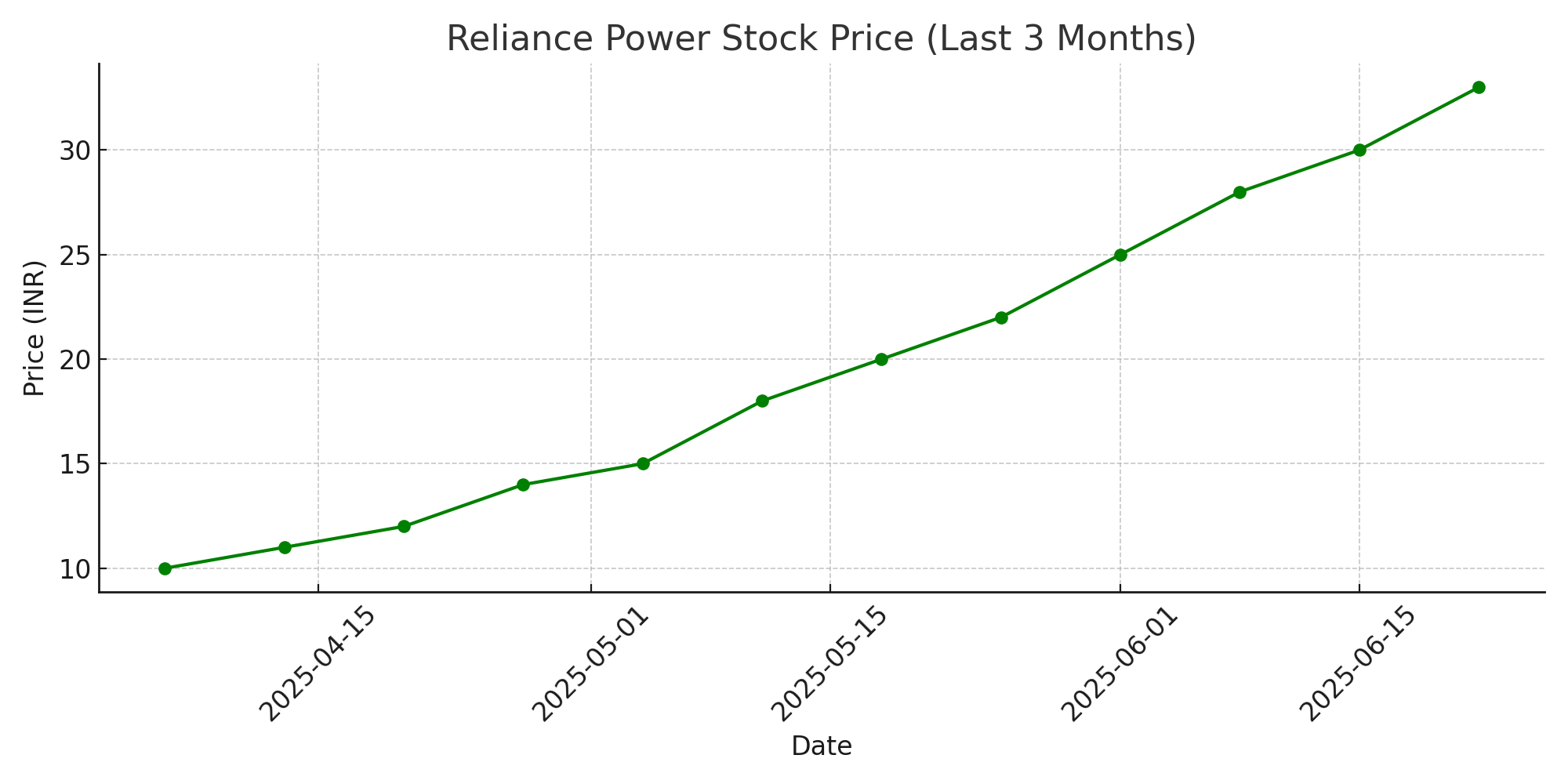

How much return did Reliance Power stock Share Price give till Friday, 27 June 2025?

As of Friday, June 27, 2025, Reliance Power stock has delivered an impressive 135.67% return over the past year, reflecting strong investor confidence and positive market momentum. 27 June 2025. And on a year-to-date (YTD) basis, this stock has seen a gain of 59.44%. At the same time, Reliance Power Company stock has seen a jump of 475.59% in the last 3 years. And in the last 5 years, this stock has seen a jump of 1641.54%.

A story of making money is being created again.

Recent developments, such as new orders and clearance in the SECI case, have helped the stock to emerge. It is truly becoming a story of money to poverty and making money again. This growth is not limited to Reliance Power alone, but all the stocks of the Anil Ambani Group have been trending well in recent weeks.

If you are wondering why Reliance Power is rallying, the gains over the past month are due to a landmark renewable energy partnership with a Bhutanese company.

🔧 Key Drivers Behind the Surge in Reliance Power Share Price

Largest Solar Power Project

Reliance Power has partnered with Druk Holdings and Investments (DHI) to set up Bhutan’s largest solar power project in a Rs 2,000 crore joint venture.

Raised Rs 350 crore in May 2025 by issuing preferential shares.

Apart from this, the company has recently invested capital to strengthen its growth plans. Reliance Infrastructure, the promoter, received 9.55 crore equity shares from the company, while Besra Home Finance Private Limited, the public, received 1 crore shares. Earlier, the company had raised Rs 1,525 crore through a primary issue in October 2024.

What did experts of the Anand Rathi brokerage firm say?

Jigar S. Patel, technical research analyst at Anand Rathi Broking firm, said, “Support is at Rs 60 and resistance is at Rs 65. Further upside towards Rs 68 may result from a clear rise above the Rs 65 barrier. For the short term, the trading range is expected to be between Rs 58 and Rs 68.

Stock Technical

The 5-day, 10, 20, 30, 50, 100, 150, and 200-day simple moving averages (SMAs) are all above the stock’s current price. Its 14-day Relative Strength Index (RSI) reads 80.47. A figure above 70 is considered overbought, while a level below 30 is considered oversold.

The company’s shares have a price-to-earnings (P/E) ratio of 386.88, while the price-to-book (P/B) value is 2.71. Earnings per share (EPS) were 0.16, and return on equity (RoE) is 0.71. According to Trendlyne data, Reliance Power has a one-year beta of 1.3, highlighting its high volatility and sensitivity to market movements.

What did the Sharekhan broking firm say?

Share market analyst Jatin Gedia from top broking firm Sharekhan advised that existing investors in this stock should capitalize on the momentum upward, but they should also set a trailing stop loss. Reliance Power Limited is a high-risk, high-reward stock. Investors aiming to buy at current levels should place a stop loss at Rs 50. Gedia also mentioned that Reliance Power stock could rise to the target range of Rs 68–72.

Friday, June 27, 2025— Reliance Power Company Share Target Price

Friday, June 27. According to the update from Dalal Street at 11:05 am on 2025, Sharekhan Broking Firm has given a hold tag on the shares of Reliance Power Company. Sharekhan Broking Firm has set a target price of Rs 72 on Reliance Power stock. In this way, Reliance Power stock can give an upside return of 6.98% to investors in the future. Shares of Reliance Power are currently trading at Rs 67.3.